Table of Contents

- Understand the return on investment in Istanbul real estate

- Determine the return on investment in Istanbul real estate

- Factors affecting the return on investment in Istanbul real estate

- Calculating the return on investment in Istanbul real estate

- Where to invest in Istanbul to achieve a high return on investment?

Understand the return on investment in Istanbul real estate

In real estate investment, the term "ROI" is of utmost importance. Return on investment (ROI) is an important metric that measures the profitability of an investment relative to its initial cost.

The real estate market in Istanbul in particular and in Turkey in general is very vital, so understanding the meaning of return on investment and how to apply it is essential for smart investors who seek to make rational and sound decisions regarding their investments.

ROI is more than just a financial measure; It is a strategic tool that enables investors to evaluate the profitability of their real estate projects. By calculating return on investment, investors can assess the effectiveness of their investment decisions, identify high-performing assets, and make informed investment choices. In Istanbul's competitive real estate landscape, analyzing return on investment is an essential step towards achieving long-term success.

Determine the return on investment in Istanbul real estate

Return on investment (ROI) is a financial metric used to measure the efficiency and profitability of an investment. In the real estate market in Istanbul, the return on investment is usually calculated by comparing the net profit or profit generated from the real estate investment against the initial investment cost. The return-on-investment formula provides a straightforward way to determine the return on investment:

Return on investment= (net income/ initial investment) x 100

Net profit is calculated by subtracting the total costs associated with the investment (such as purchase price, transaction fees, renewal costs, and running expenses) from the total revenue generated (rental income, resale proceeds, etc.), and then the result is expressed as a percentage of the initial investment, by expressing ROI as a percentage, investors can easily compare the profitability of different properties or investment opportunities, providing a clear indication of investment success.

Factors affecting the return on investment in Istanbul real estate

- Location: Istanbul's various neighborhoods have varying potential for return on investment. Prime locations, such as central business districts and tourist hubs, tend to yield higher returns due to higher demand and higher real estate values.

- Market trends: The real estate market in Istanbul is subject to fluctuations affected by varying supply and demand, economic conditions, and political conditions. Keeping abreast of market trends is critical to anticipating changes in investment return potential.

- Type of the property: Different types of real estate, such as residential, commercial, or mixed-use properties, offer distinct potential for return on investment. The purpose of the property and the target audience play an important role in determining profitability.

- Infrastructure and development: Infrastructure projects, urban renewal projects and urban development plans in specific areas can have a significant impact on the value of real estate and thus the return on investment.

- Rental demand: Istanbul's growing population, along with tourism activity and business growth, contributes to an increase in rental demand. Properties in areas with high rental demand can result in steady cash flow and high return on investment.

Calculating the return on investment in Istanbul real estate

Calculating the return on investment in Istanbul real estate includes a clear understanding of the main components that contribute to this metric:

- Initial investment: This includes the total cost incurred in acquiring a property, including the purchase price, transaction fees, legal expenses and any initial renovation or improvement costs.

- Net income: Net income includes all income generated by the property, such as rental income or resale proceeds, less any associated expenses. These expenses may include property management fees, maintenance costs, property taxes, insurance, and utilities.

Where to invest in Istanbul to achieve a high return on investment?

Beyoglu district: the cultural heart of Istanbul

Beyoglu, known for its rich history and culture, and its central and vital location, offers a promising investment scene. The area is home to many famous landmarks in Istanbul, such as Istiklal Street, Galata Tower, and Taksim Square, which makes it a center of attraction for both tourists and residents. The demand for rental properties, especially short-term accommodation, is strong in this area. In addition, the ongoing urban renewal projects and restoration efforts make Beyoglu an attractive real estate investment option with the potential for a great return on investment.

LS5: Apartments in Beyoglu close to Taksim square

Maslak district: the financial center of Istanbul

As the central business district of Istanbul, Maslak is the most attractive area for commercial and residential real estate investments in Istanbul. Featuring modern skyscrapers, high-end shopping malls, and easy access to transportation, Maslak is a top destination for business owners and companies looking for prime office spaces and luxury residences. The continuous growth and development of the area, along with its strategic importance in Istanbul's economic landscape, contributes to its ability to generate a high return on investment in the long term.

LS155: The best investment project in Vadi Istanbul area

Besiktas district: modern architecture with a historical spirit

Located along the Bosphorus Strait, the Besiktas district of Istanbul seamlessly blends historical charm with contemporary sophistication. The lively and active atmosphere of the area and the proximity to the main landmarks in Istanbul, such as the Dolmabahce Palace, create an attractiveness and importance for the area for both residents and tourists. The diverse and modern real estate market in Besiktas district offers a mix of apartments, shops, and offices, and allows for many different investment avenues. The area's potential for stable rental income and capital appreciation contributes to high investment return prospects.

LS82: Luxury apartments in Besiktas near the Bosphorus

Sisli district: Istanbul's residential, tourist and commercial center

Sisli, the center and beating heart of Istanbul, is characterized by a mixture of commercial vitality and residential attractiveness. Sisli is home to many high-end neighborhoods, such as Nisantasi district in Istanbul, the most important and prestigious shopping center in the city, where boutiques, fashion stores, and international brands abound. The strategic location of the area, the presence of various means of transportation, and its proximity to the Bosphorus, make it a prime destination for real estate investment. Investors can take advantage of the high demand for modern apartments and office space, paving the way for attractive investment return potential.

LS4: Luxury Bomonti apartments with Bosphorus view

Frequently asked questions

Return on investment (ROI) is a financial metric used to measure the efficiency and profitability of an investment. In the real estate market in Istanbul, the return on investment is usually calculated by comparing the net profit or profit generated from the real estate investment against the initial investment cost. The return on investment formula provides a straightforward way to determine the return on investment:

Return on investment = (net income/initial investment) x 100

Calculating the return on investment in Istanbul real estate includes a clear understanding of the main components that contribute to this metric:

Initial investment: This includes the total cost incurred in acquiring a property, including the purchase price, transaction fees, legal expenses, and any initial renovation or improvement costs.

Net income: Net income includes all income generated by the property, such as rental income or resale proceeds, minus any associated expenses. These expenses may include property management fees, maintenance costs, property taxes, insurance, and utilities.

Location.

Market trends.

Property Type.

Infrastructure and development.

Rental demand.

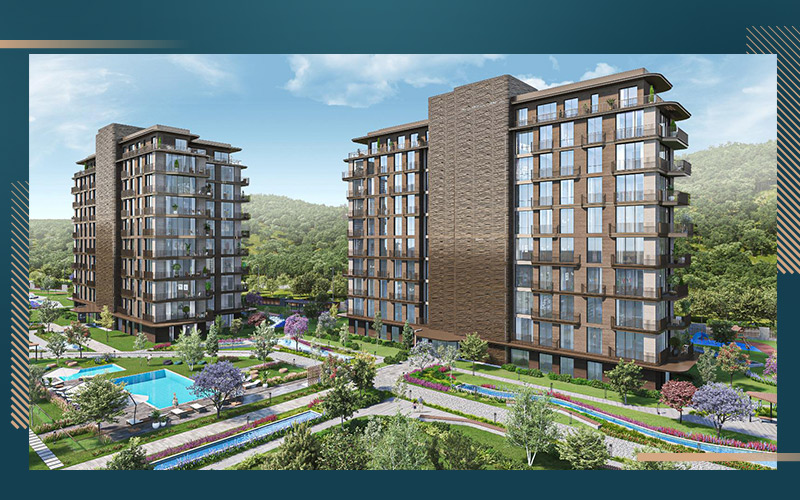

Residential complexes are gated communities that consist of multiple buildings and apartments, providing various shared facilities such as swimming pools, gyms, gardens, playgrounds, and a secure environment.

The legal procedures for purchasing property in Turkey include the following steps:

1. Verification of the title deed (tapu).

2. Verification of the legal status of the property.

3. Obtaining a tax number.

4. Opening a bank account in Turkey.

5. Signing the purchase contract between the buyer and the seller.

6. Receiving the title deed from the Land Registry Office (tapu office).

Yes, foreigners can obtain bank loans to purchase property in Turkey. Loans are provided based on the terms and guarantees specified by the bank.