Table of Contents

- Housing Sales Statistics in Turkey for December 2025

- An Analytical Reading of the Real Estate Market Based on Turkish Statistical Institute Data

- Strong Increase in Total Housing Sales in December 2025

- Remarkable Growth in Mortgage-Financed Sales

- New Homes Outperform in Growth Rates

- Overview of the Turkish Housing Market in 2025

- Foreign Housing Sales: Annual Decline with Monthly Improvement

- What Do These Figures Mean for Investors?

Housing Sales Statistics in Turkey for December 2025

An Analytical Reading of the Real Estate Market Based on Turkish Statistical Institute Data

The Turkish Statistical Institute (TÜİK) released its official report on housing sales in Turkey for December 2025, revealing a strong performance in the real estate market at the end of the year. The data showed a noticeable increase in sales volume compared to the same period of the previous year, reflecting the continued strength of domestic demand for homeownership despite ongoing economic challenges.

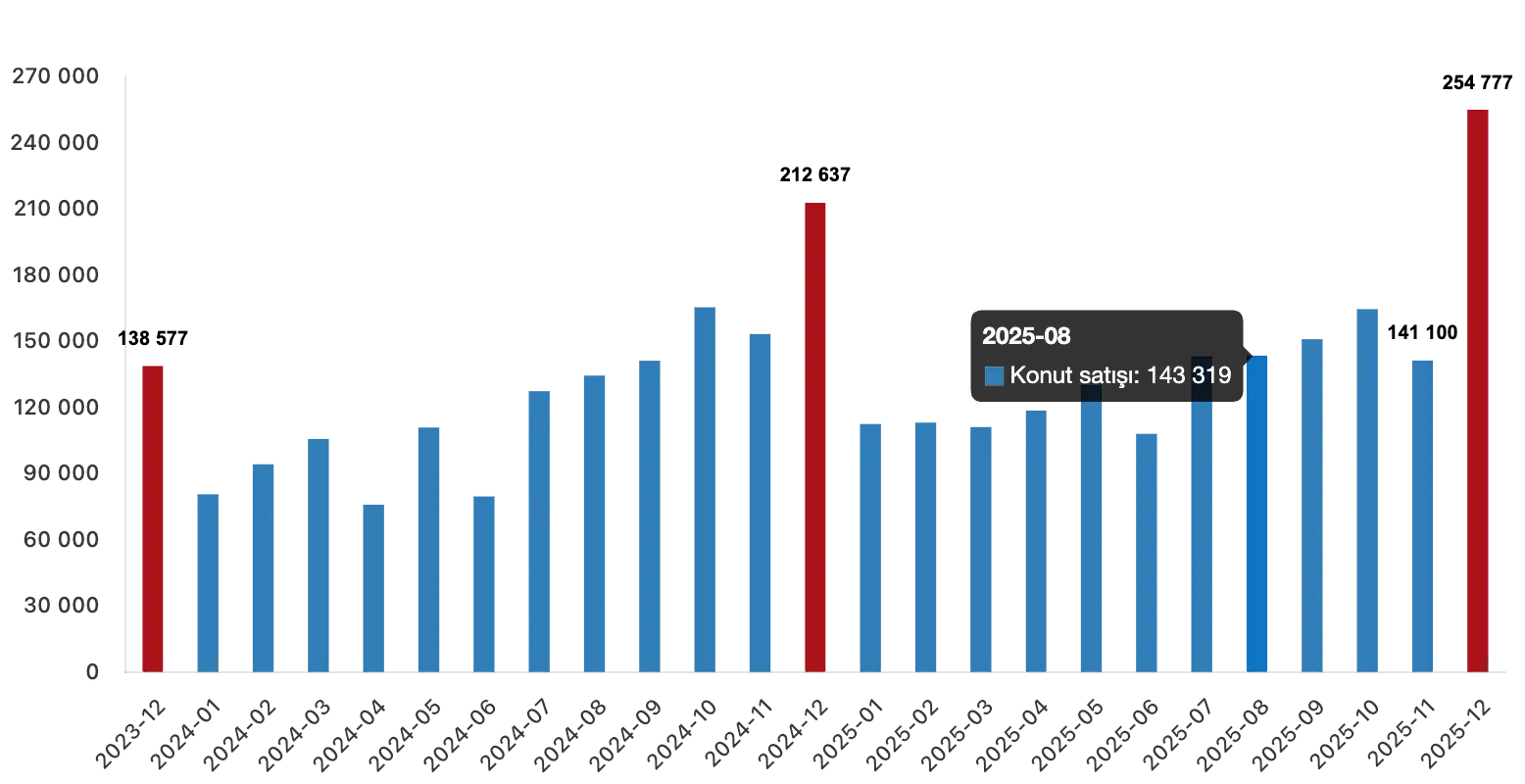

Strong Increase in Total Housing Sales in December 2025

According to the report, Turkey recorded a clear year-on-year increase in the number of homes sold in December 2025 compared to December 2024. This growth indicates a significant revival in market activity toward the end of the year, driven by several factors, most notably individuals seeking to protect their capital through real estate investment, in addition to the usual seasonal momentum in the final quarter.

The Turkish Real Estate Market Compared to Global Property Trends in 2025

Remarkable Growth in Mortgage-Financed Sales

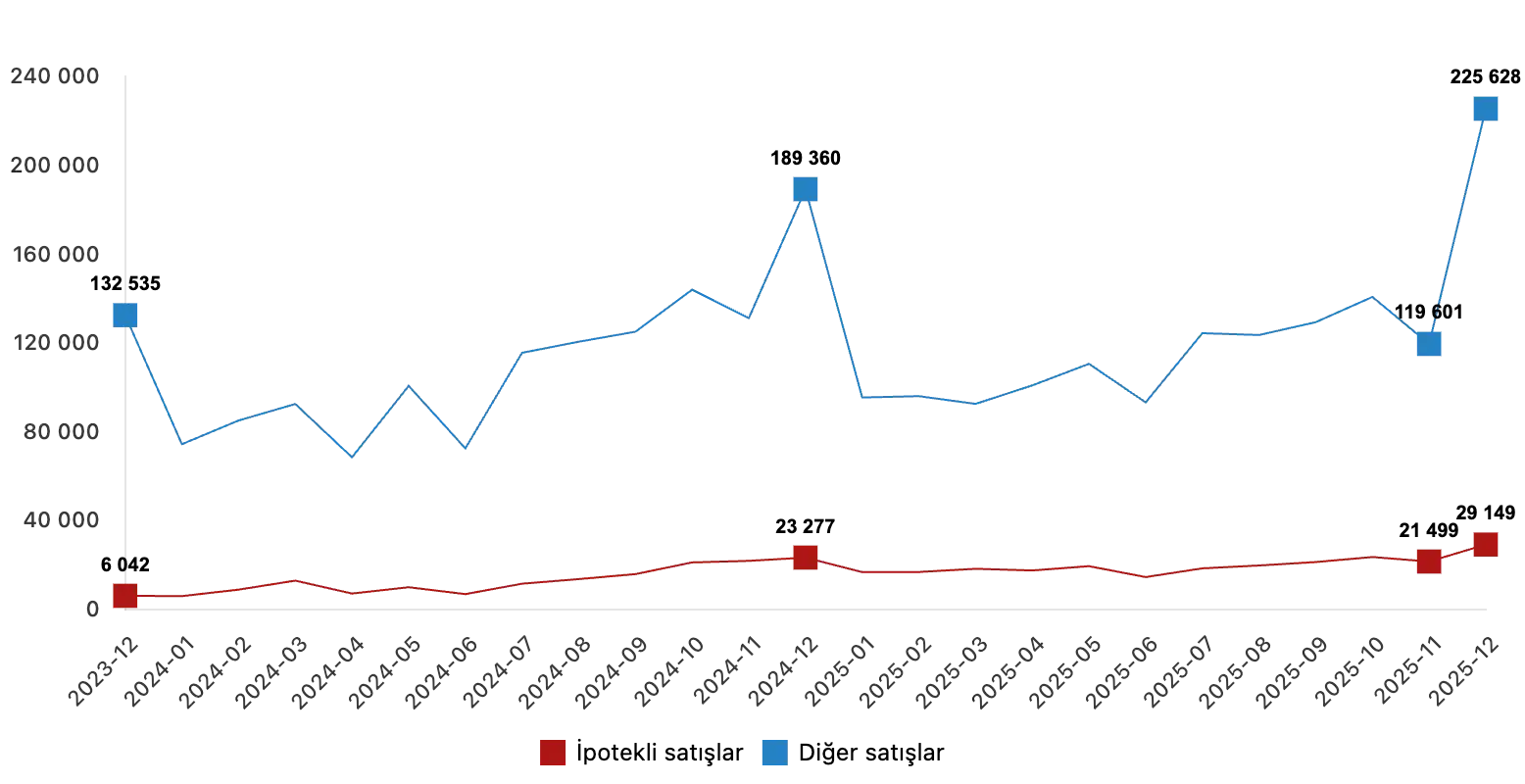

The statistics showed that mortgage-backed housing sales achieved a notable annual increase in December 2025, signaling a gradual return to bank financing for home purchases despite prevailing interest rates. This trend reflects consumer confidence in the real estate market over the medium and long term, as well as improved expectations regarding future price stability.

At the same time, non-mortgaged sales continued to account for the largest share of total transactions, confirming that a broad segment of buyers still relies on cash purchases or self-financing.

New Homes Outperform in Growth Rates

Sales of new homes (first-hand sales) recorded higher growth rates than second-hand homes in December 2025. This positive indicator highlights strong demand for newly developed residential projects and modern housing complexes, particularly in major cities and expanding urban areas.

This trend is largely attributed to buyers’ preference for new properties that offer modern specifications, higher construction quality, and flexible payment plans provided by real estate developers.

Overview of the Turkish Housing Market in 2025

On an annual basis, TÜİK data revealed that total housing sales in Turkey in 2025 increased compared to 2024, confirming that the real estate sector maintained its role as one of the key drivers of the Turkish economy.

Istanbul ranked first among cities with the highest number of housing sales in 2025, followed by Ankara and Izmir. This ranking reflects the population density and economic weight of these cities, as well as sustained residential and investment demand.

Foreign Housing Sales: Annual Decline with Monthly Improvement

The statistics indicated a decline in total housing sales to foreigners in 2025 compared to the previous year, potentially linked to regulatory changes, residency and citizenship requirements, and exchange rate dynamics.

However, December 2025 recorded a relative improvement in foreign sales compared to December 2024, demonstrating continued foreign investor interest in the Turkish real estate market, particularly in cities such as Istanbul, Antalya, and Mersin.

What Do These Figures Mean for Investors?

The December 2025 housing statistics highlight several key signals, most importantly that domestic demand remains the primary driver of Turkey’s real estate market, and that property continues to be viewed as a safe haven during periods of economic uncertainty. The strong performance of new home sales also opens attractive investment opportunities in ongoing and upcoming development projects.

For foreign investors, despite the annual decline, the Turkish market still offers appealing medium- and long-term opportunities, especially in major cities and high-demand touristic and investment areas.

Conclusion

Housing sales data for Turkey in December 2025 confirm that the real estate market closed the year with positive momentum, marked by clear growth in sales volumes, strong performance of new homes, and the continued importance of real estate as a stable investment option in Turkey. This dynamic is expected to continue in the coming periods, closely linked to economic policies, interest rates, and domestic and foreign demand.

Frequently asked questions

Yes, the rise in sales at the end of 2025 reflects the strength of genuine market demand and is a positive indicator of market liquidity and its ability to absorb new investments, especially in major cities.

Increased domestic demand means a consistent buying base, which is an important factor for investors seeking faster resales or stable rentals. It also reduces the risk of fluctuations in external demand.

Istanbul leads the investment landscape, followed by Ankara and Izmir, due to consistent demand, strong infrastructure, and diverse opportunities across residential, rental, and long-term investment.

Yes, Turkey remains an attractive market thanks to the variety of real estate options, rental yields, and large market size, especially for investors with a medium- to long-term vision.

Yes, strong local demand and a diverse range of tenant segments make rental investment a stable option, especially in major cities and areas close to business and service centers.